Customs Process for Export of Processed Food

Customs Process for Export of Processed Food Links

Bangladesh Customs under the National Board of Revenue is responsible for the clearance process of export goods. To promote and encourage export, Bangladesh Customs facilitates the export procedure with a simplified process. To export food products, the exporters need to obtain Health Certificate, Halal Certificate (if applicable) issued by the competent authority and other necessary documents as per the importing country's (destination) requirements.

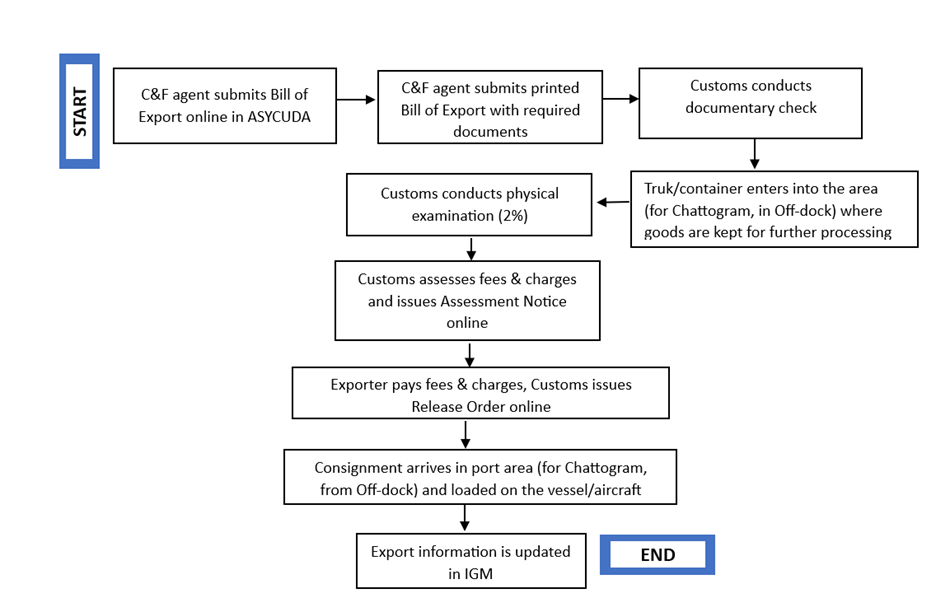

Flow Chart of Process:

Fees and charges:

- Document processing fee: BDT 30.00 per Bill of Export (Customs)

- Other applicable fees and charges are realized by the concerned port authority

Detailed Procedure:

Step 1: C&F agent submits Bill of Export online to the ASYCUDA World system

Step 2: C&F agent submits printed Bill of Export along with the following documents to Customs

- Export L/C; if there is no Export L/C, Export Contract/Purchase Order/Export Guarantee, etc. approved by the negotiating bank

- Commercial Invoice

- Packing list

- Detailed Packing List

- EXP Form certified by Authorized Dealer (AD)

- Certificate of Origin of export goods (issued by EPB or Chamber of Commerce and Industry of Bangladesh)

- VAT/BIN Certificate

- Health Certificate issued by competent authority (e.g BFSA/Concerned Regulatory authority)

- Halal Certificate issued by BSTI/Islamic Foundation

Step 3: Customs checks all documents and forward for physical examination

Step 4: (At Chattogram Seaport) Truck/container enters into off-dock, unloading of truck commences

(At Dhaka Airport) Biman Bangladesh Airlines issues gate and driver’s pass and truck enters into export cargo village

(At Benapole Land Port) Consignment arrives at the export yard

Step 5: Customs conducts physical examination (Customs examines 2% of each consignment)

Step 6: Customs assesses fees and charges and issues Assessment Notice, and keep the print version in file/folder

Step 7: Exporter pays the fees and charges through the e-payment system to the authorized bank as per the Assessment Notice; then Customs issues Release order online

Step 8: At this stage, basic Customs clearance process is completed.

After this, at Chattogram Seaport, goods stuffed into container, container exits from the off-dock to the port, container arrives at the port. Then container is loaded into the vessel, and the shipping agent obtains clearance from Customs and Port.

At Dhaka Airport, C&F submits the documents to Civil Aviation Authority for scanning permission, goods are scanned, Airway Bill is issued and then goods are handed over to the airlines.

At Benapole Land Port, C&F agent obtains car pass and gate pass, and truck exits Bangladesh.

Step 9: Export information is then updated in the EGM by C&F Agent/Shipping Agent (For Chattogram Seaport).

Concerned Legislation:

- Customs Act, 2023

- Prescribed Bill of Entry and Bill of Export Form Order, 2001

- Export Policy 2021-2024

Note: Under Custom House, Chattogram, all export items are exported through Private ICD/Off-dock.