Customs Clearance Process for Import of Processed Food

Customs Clearance Process for Import of Processed Food Links

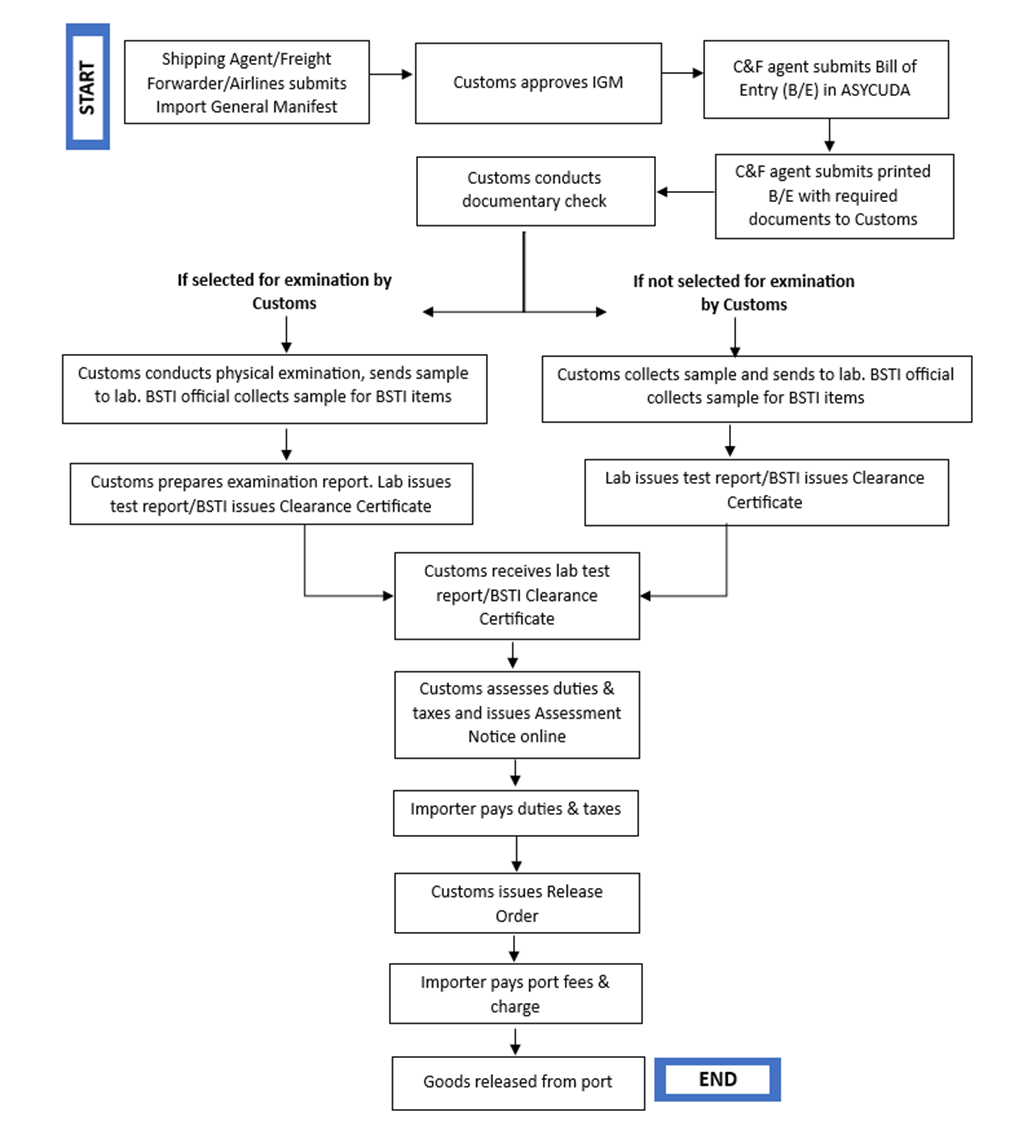

Bangladesh Customs under the National Board of Revenue is responsible for the Customs clearance process of imported goods. The procedure includes submission Bill of Entry in the Customs online system, documentary checks, importability assessment, physical inspection (for selected consignment), duty-tax assessment, duty-tax payment, etc. After duty-tax payment, the importer releases the goods from the port by completing the necessary port clearance procedure. As per the Import Policy Order (IPO), BSTI listed food items in Annexure-4 are cleared subject to receiving Bangladesh Standards and Testing Institution (BSTI) Clearance Certificate. Other foodstuffs are tested at Bangladesh Council of Scientific and Industrial Research (BCSIR) or Bangladesh Reference Institute for Chemical Measurements (BRiCM) or any Bangladesh Accreditation Board (BAB) Accredited Labs that are not involved in food-related business or any other Government approved labs. Radioactivity test is also done by the Bangladesh Atomic Energy Commission (BAEC) for foodstuffs other than from SAARC countries. All these documents are checked by customs and the goods are released.

Flow Chart of Clearance Process:

Fees & charges:

- Document processing fee: BDT 30.00 per Bill of Entry (Customs).

- Other applicable fees and charges are realized by the concerned port authority.

Detailed Procedure of Customs Clearance:

Step 1: Shipping agent/Freight Forwarder/Airlines submits Import General Manifest (IGM) online into the ASYCUDA World system.

Step 2: Customs approves the manifest.

Step 3: C&F agent submits Bill of Entry (B/E) to the ASYCUDA World System.

Step 4: C&F agent submits printed Bill of Entry (B/E) along with the following documents:

- Authorization Letter to the C&F agent issued by the importer

- VAT/BIN Certificate

- Bank-endorsed Letter of Credit (Customs copy)

- Bank-endorsed Pro-forma Invoice

- Bank-endorsed Commercial Invoice

- Value Declaration Form

- Bank-endorsed Packing List

- Detailed Packing List

- Bank-endorsed original copy of Waybill (Bill of Lading/Airway Bill/Truck Receipt/Rail Receipt)

- Insurance Cover Note

- Country of Origin Certificate

- Bill of Entry datasheet signed by the C&F agent

- Fit for Human Consumption Certificate issued by the competent authority of the exporting country

- Radioactivity Certificate issued by the competent authority of the exporting country

Step 5: Customs checks all the documents and forwards for physical examination (if the consignment is selected for physical examination based on risk assessment).

Step 6: Customs conducts physical examination (if selected) and collects samples for radioactivity test and sends to BAEC. Customs also sends samples to BCSIR/BRiCM/other labs for Fit for Human Consumption Test. For products requiring mandatory testing by BSTI as per IPO, samples are collected by BSTI official.

Step 7: Customs issues physical examination report (if an examination is conducted) and receives test report from the above-mentioned lab or BSTI Clearance Certificate.

Step 8: Customs assesses duties and taxes and issues Assessment Notice online and keep the print version in file/folder.

Step 9: (Applicable only for sea cargo; for others directly Step 10): C&F agent collects Delivery Order (DO) from the shipping agent/freight forwarder.

Step 10: Importer pays the duties and taxes through the e-payment system to the authorized bank as per the Assessment Notice.

Step 11: Customs issues Release Order online.

Step 12: Importer pays Port fees & charges.

Step 13: Goods are released from the Port.

Concerned Legislation:

- Customs Act, 2023

- Prescribed Bill of Entry and Bill of Export Form Order, 2001

- Import Policy Order 2021-2024

Duty & Tax Benefits for de minimis Consignment:

Subject to the provisions laid down in the Customs (de minimis) Rules, 2019, non-commercial import consignment valued up to BDT 2000 (two thousand taka only) and also the duties & taxes not being more than BDT 2000 (two thousand taka only) can be imported without payment of any Customs Duty, and other duties and taxes.